Credit Check with CCR: Unlocking Financial Success Before Seeking Asset Finance 2024

Credit Check with CCR

Do you have a clean credit record from the Irish Central Credit Register (CCR)? If you have any repayments recorded as missed in the past, what was the reason and are any problems resolved from the past? Meeting these requirements doesn’t guarantee approval, as each lender have their own specific credit policy, criteria and assessments. However, preparing thoroughly and understanding what’s expected can significantly improve your chances of securing car and/or asset finance with Vendor Finance.

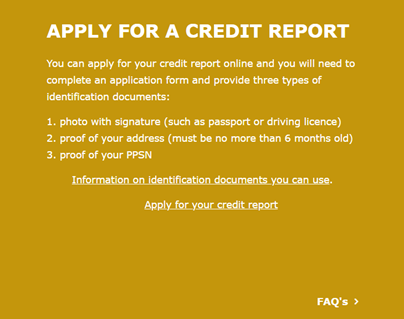

Before diving into finance, ensure a smooth journey by checking your credit history first! It’s the key to unlocking better rates, avoiding surprises, and securing your financial future. You can apply for a full credit report, here.

Understanding the Central Credit Register (CCR)

The CCR serves as a centralised database managed by financial authorities, compiling credit information of individuals and businesses. It provides a comprehensive overview of borrowers’ credit history, including details of existing loans, repayment behaviour, and any defaults or issues. This information provided by the CCR, enables lenders to make more informed decisions when assessing credit applications. It can also help you understand where you stand when applying for finance.

Simplifying Asset Finance Applications

When applying for asset finance, having a positive credit history can significantly enhance your prospects of approval and favourable terms. Here’s how the CCR can help streamline the asset finance application process:

Comprehensive Credit Assessment: Lenders can access your credit report from the CCR to gain insights into your financial standing. This allows them to assess your creditworthiness more accurately, considering factors such as your repayment track record and debt-to-income ratio.

Faster Approval Process: With access to real-time credit information through the CCR, lenders can expedite the approval process for asset finance applications. This means reduced waiting times and quicker access to the funds needed to acquire the desired assets.

Improved Transparency: The CCR promotes transparency in the lending process by providing both borrowers and lenders with a standardised platform for credit assessment. Borrowers can also review their credit reports to ensure accuracy and address any discrepancies that may affect their asset finance applications.

Risk Mitigation: By leveraging the data available in the CCR, lenders can better evaluate the risk associated with extending asset finance. This can lead to more tailored loan offers, including competitive interest rates and repayment terms based on your credit profile.

Steps to Utilize the CCR for Asset Finance

To make the most of the CCR when applying for asset finance, consider the following steps:

Monitor Your Credit Report: Regularly review your credit report from the CCR to stay informed about your credit status. Address any errors or inaccuracies promptly to ensure your credit profile accurately reflects your financial history.

Maintain Good Credit Practices: Demonstrating responsible financial behaviour, such as making timely loan repayments and managing debt effectively, can positively impact your credit standing. Consistent positive activity reflected in the CCR can strengthen your asset finance application.

Seek Professional Guidance: If you have concerns about your creditworthiness or need assistance understanding your credit report, don’t hesitate to seek advice from financial professionals or credit counsellors. They can offer insights and strategies to improve your credit profile.

In short, the Central Credit Register (CCR) plays a pivotal role in enhancing the efficiency and transparency of asset finance applications. By leveraging the comprehensive credit information provided by the CCR, both borrowers and lenders can benefit from a streamlined process, faster approvals, and better-informed decision-making. By understanding how the CCR works and taking proactive steps to maintain a positive credit profile, individuals and businesses can optimise their chances of securing asset finance and realising their objectives.

Before embarking on your journey to secure asset finance with Vendor Finance, it’s crucial to assess your credit standing. In Ireland, the Central Credit Register (CCR) serves as the go-to resource for understanding your credit history. It provides a comprehensive overview of your borrowing behaviour, including any missed repayments or defaults in the past.

Apply for car or commercial asset with Vendor Finance today, click here or get in touch to start your application at 07109310137. Avoid surprises when applying for finance! Knowing your credit history can higher your approval rate with our lenders which leads you to more financial success!

#Creditcheck#Smartfinances